Semiconductors in automotive

Semiconductors in automotive

The recent chip shortage highlighted the crucial role of semiconductors in modern vehicles. As we look to the future of mobility, the importance of these small components in cars will only grow.

Ensuring a robust semiconductor supply chain is essential but not sufficient. Many groundbreaking functionalities of future vehicles depend on chip innovations yet to be developed.

The silicon revolution in automotive

In the past few decades, semiconductors have assumed more functions in our vehicles, from automatic windshield wipers to adaptive cruise control. Depending on the model, you’ll find between 1,000 and 3,000 chips in a modern car.

This number is expected to rise in the coming years. Major trends in automotive—electrification, advanced ADAS, autonomous driving, and digital driver and passenger experiences—all rely on semiconductor technologies.

The growing number of chips in a car is certainly one challenge for auto manufacturers, but it’s not the most critical.

What characterizes this next silicon revolution in automotive is the need for highly innovative semiconductor technologies. And the way companies address this need will determine the industry's future.

Semiconductor-driven innovations in automotive

Enabling tomorrow’s software-defined vehicles will require innovations in several domains of semiconductor technology:

1. Computing hardware

The car of the future is often described as a 'supercomputer on wheels.' Advanced ADAS and autonomous driving functionalities require computational power far beyond current capabilities. Since most of these functions are time-critical, relying on cloud data centers is not an option.

Integrating advanced logic chips into a car is challenging. Unlike servers, which are housed in climate-controlled environments with stable power supply, chips in cars are constrained by the power a battery can deliver, making energy efficiency a constant concern.

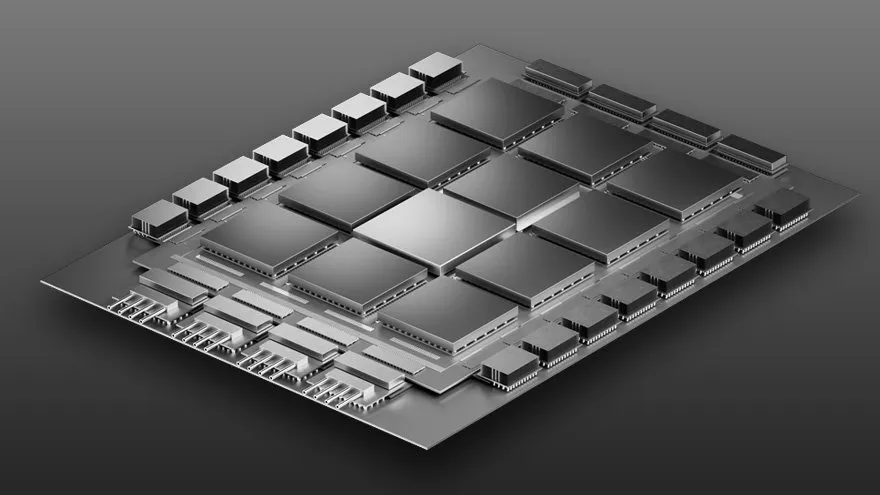

Monolithic IC designs can no longer meet the required computational power cost-effectively, pushing the need for chiplet architectures. This shift could also enhance supply chain resilience and innovation, provided industry-wide standards are established.

There’s work to be done to ensure that chiplet architectures – just like all automotive semiconductor technologies – conform to the industry’s rigorous quality and reliability requirements.

Solutions to challenges related to automotive chiplets are being addressed in the Automotive Chiplet Forum (previously ACA conference), initiated by imec and now organized by star.

2. Sensor chips

Next-gen vehicles will perform extensive AI computations on massive amounts of data from a diverse array of sensors monitoring and mapping the car’s environment. This will significantly improve traffic safety.

To achieve this, we need to increase the number of sensors in cars while reducing their size and cost. Additionally, enhancements in sensing technology are necessary to ensure a comprehensive monitoring and mapping of the car’s surroundings, regardless of weather and lighting conditions.

Semiconductor technology can bring advanced sensing modalities like lidar, imaging radar, and infrared camera systems onto small, mass-producible chips, enabling cost-effective integration into car models.

A critical piece is integrating sensing and computation, ensuring that the vehicle can utilize, in real time, the vast amounts of information its sensors bring in.

Furthermore, deploying sensors inside cars can enhance the digital experience of drivers and passengers with functions like voice and gesture control, haptic feedback, and even holographic displays.

Finally, sensors in the cabin can monitor the driver’s vital signs (blood pressure, heartbeat, etc.), further improving safety, including in autonomy levels 2 and 3 when handoffs between the AV and a human driver are necessary.

3. Power and energy

In cars powered by internal combustion engines, chips optimize fuel efficiency. With the shift to fully electric drivetrains, semiconductors play an even larger role in managing a vehicle’s power supply.

Chips with lower power losses can enable smaller batteries or extend driving ranges. Advanced battery management software and higher-voltage architectures based on wide-bandgap semiconductor materials like gallium nitride (GaN) in switches, converters, and other power management components enhance their energy efficiency and heat tolerance. This streamlines thermal management and reduces weight, ultimately extending range, speeding charging times, and improving EV performance and reliability.

4. Connectivity

Robust semiconductors are needed to ensure future vehicles' connection to:

- the cloud – for non-critical AI processing and over-the-air software updates

- each other (vehicle-to-vehicle communication/V2V) – for real-time alerts, blind spot detection, collision avoidance, cooperative adaptive cruise control, etc.

- road and city infrastructure (vehicle-to-everything/V2X) – for collision avoidance, efficient traffic management, etc.

Many of these communications will rely on advanced connectivity technologies like 5G/6G.

Need for cross-industry and global collaboration

The recent chip shortage galvanized support for growing and diversifying semiconductor manufacturing. Building on that momentum, the automotive industry must engage in conversations about semiconductor technology roadmaps to ensure its needs are met.

Star, and its U.S. hub mstar, were established to facilitate this dialogue, bringing automotive and semiconductor experts together in a global network. Together, they can elevate automotive semiconductor technologies to new heights, building a thriving automotive sector based on clean, comfortable, and safe mobility options.